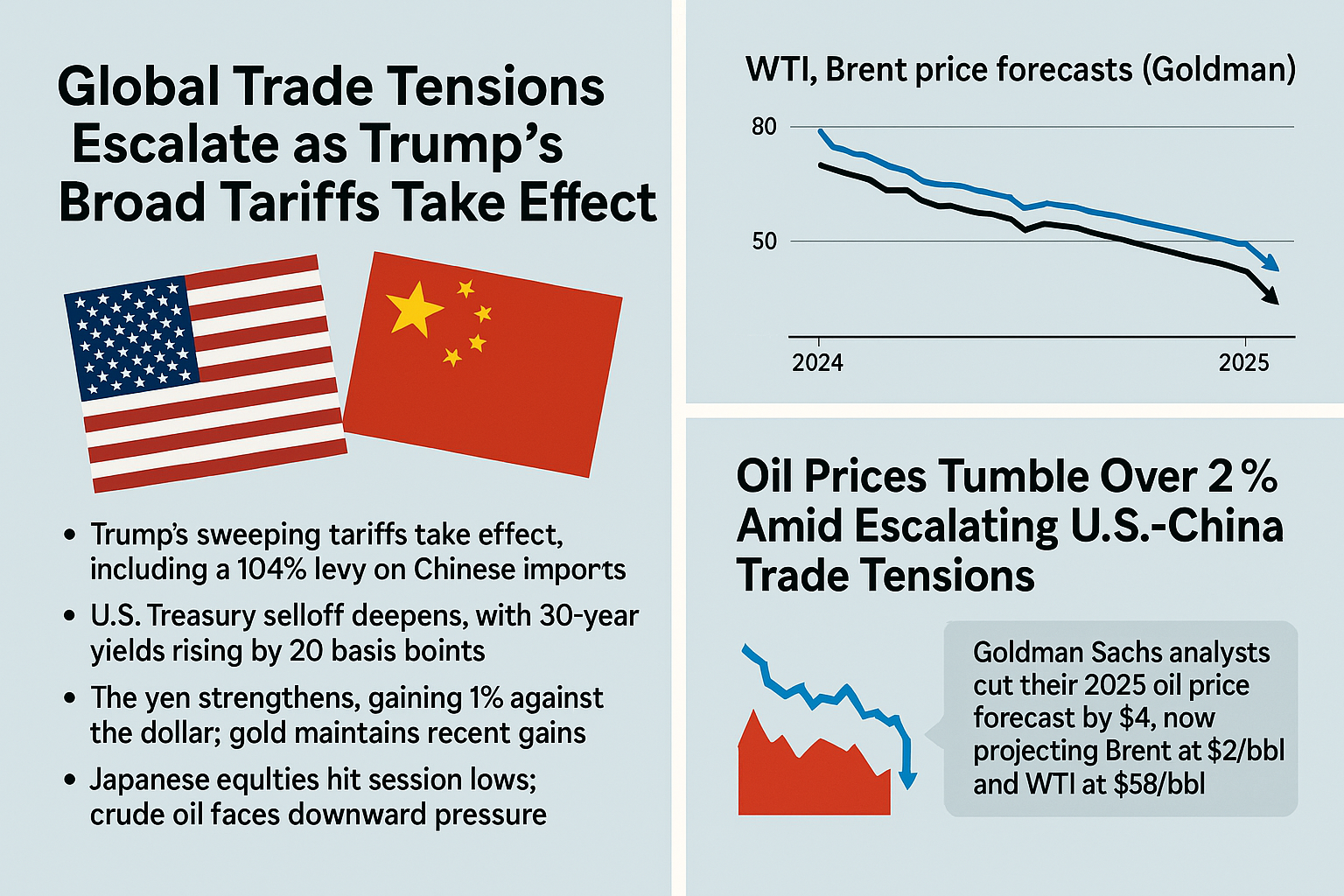

Oil prices dropped sharply on Monday during a volatile trading session, as President Trump threatened to impose additional tariffs on China—rattling markets and dragging down stocks.

West Texas Intermediate (CL=F) futures briefly dipped below $60 per barrel for the first time since 2021, before recovering slightly to close at $60.70. Brent crude (BZ=F), the global benchmark, also slid, ending the day at $64.21 per barrel.

Trump announced plans to introduce an additional 50% tariff on Chinese imports if Beijing does not roll back the 34% tariffs it implemented last week in response to sweeping U.S. levies revealed on April 2.

Crude prices momentarily rebounded as equity markets—the S&P 500 (^GSPC), Dow Jones Industrial Average (^DJI), and Nasdaq Composite (^IXIC)—whipsawed between gains and losses following a social media post claiming Trump was considering a 90-day pause on new tariffs. The White House later dismissed the report as “fake news.”

Oil has already seen significant declines, dropping 11% last week amid fears that Trump’s aggressive trade policies could erode global demand.

Adding to the pressure, Saudi Arabia over the weekend slashed crude export prices to its Asian customers by $2.30 per barrel for May. This move followed OPEC+’s announcement of a larger-than-expected production increase for the coming month.

Despite the selloff, some analysts believe a price floor could be forming.

“We see incentive for defense at $60 per barrel, both from the standpoint of OPEC+ budget needs and the U.S. administration’s interest in safeguarding shale economics,” Citi analysts noted in a Monday report.

Energy-related stocks (XLE) have led recent market declines since Trump’s tariff announcement last Wednesday. On Friday, WTI plunged over 7% after China—the world’s largest crude importer—announced retaliatory tariffs of 34% on U.S. goods.

Goldman Sachs analysts cut their 2025 oil price forecast by another $4 on Sunday night, following a $5 reduction just days earlier.

“We are lowering our outlook further to reflect recent GDP downgrades from our economists, including expectations of a stagnating U.S. economy,” said Daan Struyven, co-head of global commodities research at Goldman Sachs.

The bank now projects Brent crude to average $62 per barrel in 2025, with West Texas Intermediate (WTI) forecasted at $58.