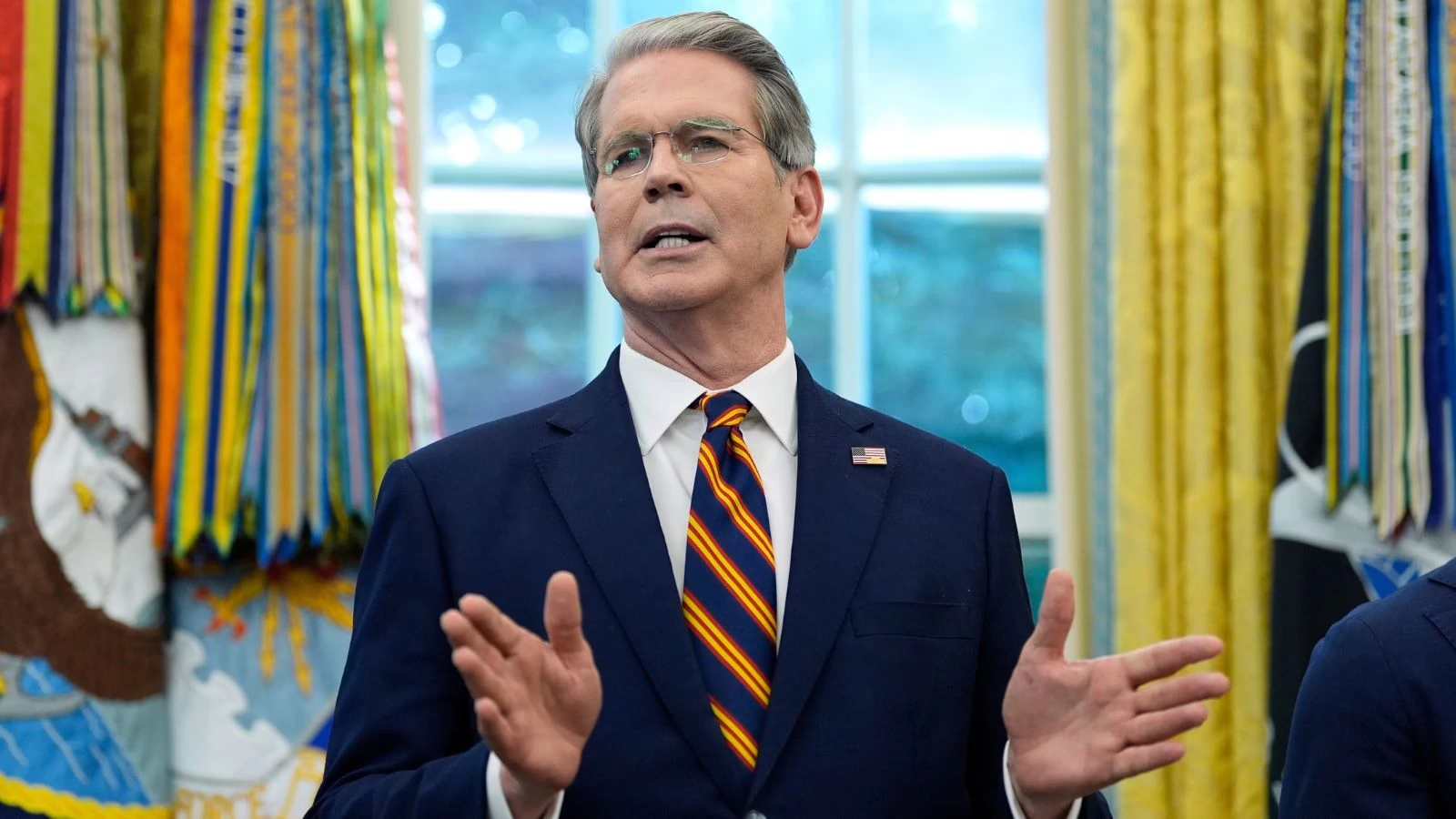

In a significant and strategic announcement on September 15, 2025, U.S. Treasury Secretary Scott Bessent stated that the United States will not impose tariffs on China over its continued purchase of Russian oil—unless European countries take the lead by implementing similar measures. This position reflects a carefully calculated approach by the U.S., focusing on multilateral coordination to maximize pressure on Russia while maintaining economic stability.

Clear Strategy of Multilateral Pressure

At the heart of Secretary Bessent’s remarks was the principle that no unilateral action should be taken in isolation. “We expect the Europeans to do their share now,” Bessent emphasized. “We will not move forward without the Europeans.” The U.S. is actively encouraging its European allies to impose secondary tariffs on countries importing Russian oil, particularly China and India, to collectively reduce Russia’s main revenue stream supporting its military operations in Ukraine.

This policy stands in contrast to unilateral measures and highlights Washington’s effort to create a unified front among democratic nations. Bessent explained that coordinated action would be more effective in forcing Russia to reconsider its aggressive stance.

Current U.S. Measures and Global Coordination

Until now, the United States has taken targeted steps, such as imposing a 25% tariff on Indian imports linked to Russian oil purchases. The administration has also discussed plans to implement similar duties on Chinese goods, with proposed tariffs ranging from 50% to 100%.

However, the U.S. will refrain from enforcing tariffs on Chinese goods over Russian oil purchases unless Europe leads by example. This cautious stance aims to avoid disrupting global markets and ensures that action is taken collectively.

“We are not going to impose tariffs on China unless our European allies go first,” Bessent said clearly during a press briefing. “It is essential that all of us work together in this effort.”

China’s Firm Response

China has repeatedly maintained that its trade decisions, including the purchase of Russian oil, are matters of national sovereignty. During recent trade talks in Madrid, Chinese officials emphasized that external pressures on their energy trade were unacceptable.

This clash of principles between the U.S. and China reflects deeper tensions in the ongoing global struggle over energy, national security, and economic power. Beijing argues that its continued energy trade with Russia is lawful and that any interference infringes on its sovereignty.

The Larger Goal: Ending the Russia-Ukraine Conflict

One of the primary motivations behind this proposed tariff strategy is to diminish Russia’s economic capacity to sustain its war in Ukraine. Bessent argued that if European countries imposed significant tariffs on Russian oil purchases by China and India, Russia’s main revenue source would dry up.

“This coordinated approach could potentially lead to the resolution of the conflict within 60 to 90 days,” Bessent said, adding that targeting Russian oil majors like Rosneft and Lukoil is essential to achieve this goal. Furthermore, he highlighted the idea of using frozen Russian sovereign assets to help support Ukraine during this critical time.

Economic and Diplomatic Ramifications

The strategy to withhold unilateral action until Europe acts signals a shift toward multilateralism in international trade and foreign policy. It avoids the risk of an economic trade war between the U.S. and China and emphasizes a united global front.

Economists warn that imposing tariffs on Chinese goods could have far-reaching consequences, possibly triggering supply chain disruptions and raising costs for American consumers. By conditioning such tariffs on European participation, the U.S. seeks to avoid these risks while still applying diplomatic pressure.

Dr. Julia Parker, geopolitical analyst at the Center for Global Studies, noted, “Bessent’s remarks demonstrate a balanced strategy. He’s sending a clear message to the global community: the solution lies in collective action, not individual measures.”

Implications for Global Energy Markets

As energy prices remain volatile due to ongoing geopolitical tensions, any move to restrict Russian oil further could impact global markets significantly. The U.S. Treasury’s strategy indicates a desire to avoid destabilizing energy supplies, instead favoring a gradual reduction in Russian oil revenue through diplomatic consensus.

What’s Next?

European leaders are now under significant pressure to act, with the global community watching closely. If the EU and other European nations align with the U.S. position, a major shift in global trade relations is expected. Conversely, reluctance from Europe could lead to renewed diplomatic challenges between Washington and Brussels.

Treasury Secretary Bessent concluded, “We are prepared to take further action, but only in close cooperation with our European partners. It is a time for unity, not unilateralism.”