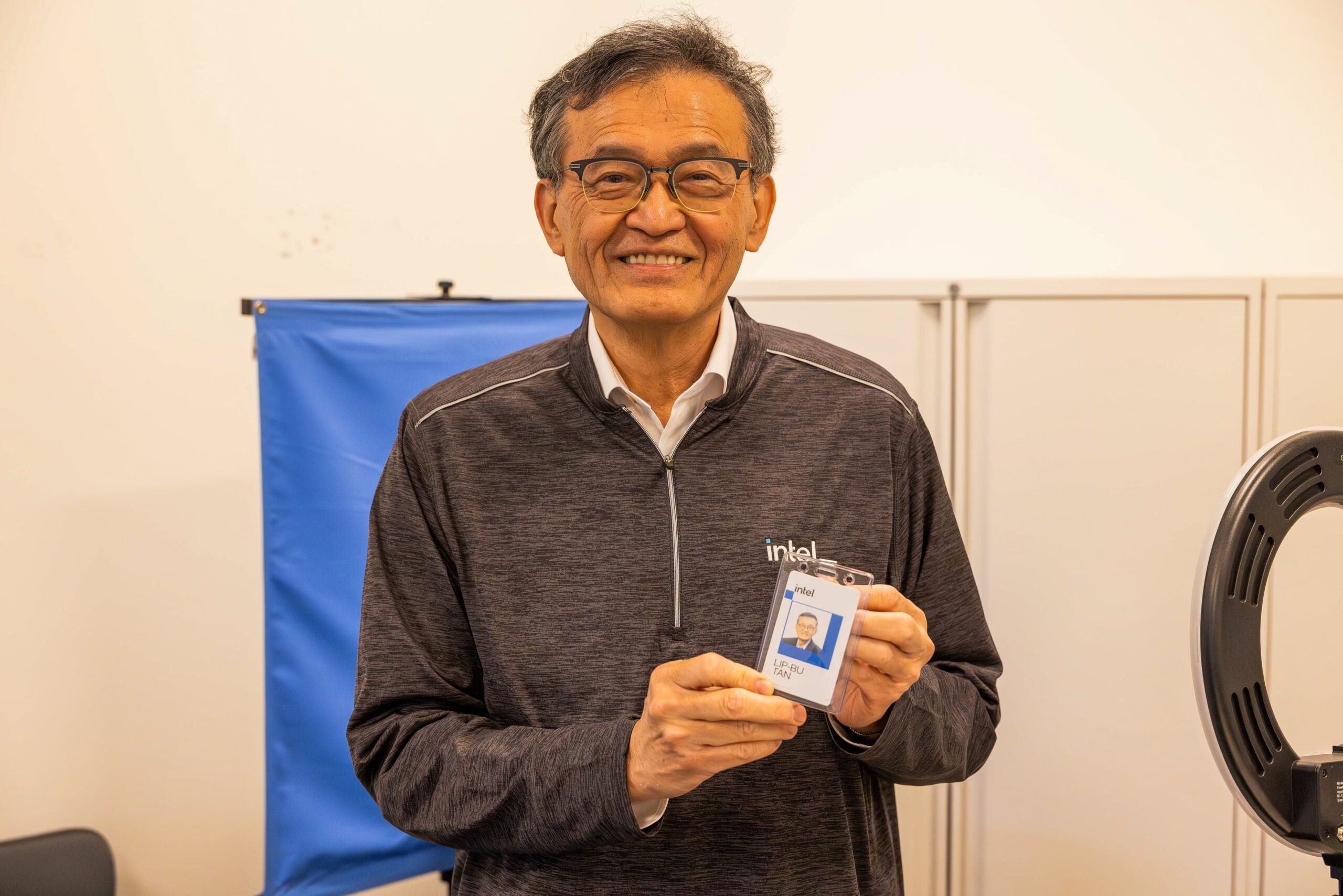

SAN FRANCISCO – Intel’s newly appointed CEO, Lip-Bu Tan, is evaluating a significant change to the company’s chip foundry business, signaling a possible departure from the manufacturing strategy pursued by his predecessor, Pat Gelsinger.

Image source: newsroom.intel

18A Process Under Review

At the heart of the review is Intel’s 18A manufacturing process, which was meant to leapfrog competitors like TSMC by introducing innovative transistor architecture and a novel power delivery system. Former CEO Pat Gelsinger had made 18A the centerpiece of Intel’s comeback strategy, with billions already poured into development.

However, sources familiar with internal discussions say that Tan is now questioning whether continuing to market 18A to external clients makes financial sense. The process has struggled to attract major customers, especially as TSMC’s N2 technology nears production and Intel’s own 18A faced delays.

If Intel abandons external sales of 18A and its variant 18A-P, the company may have to take a major write-down. Analysts estimate the potential financial hit could reach hundreds of millions or even billions of dollars.

Strategic Pivot to 14A

Rather than continue pushing 18A to foundry clients, Tan is reportedly redirecting focus toward a newer process: 14A. Intel believes 14A may give it a better shot at winning key contracts from companies like Apple and Nvidia, which currently manufacture their chips through TSMC.

“Tan wants to position 14A as Intel’s best bet to compete for next-generation chipmaking deals,” said one source familiar with the discussions.

The company is already tailoring 14A for specific customer needs — a move that reflects a more client-driven approach than the 18A push, which was largely internal.

Board Decision Expected

Intel’s board is expected to consider the potential shift as early as this month. However, due to the financial implications and technical complexity, a final decision may not come until a follow-up meeting in the fall.

While no official decision has been made, Intel confirmed it will continue producing 18A chips for internal projects and existing contracts, including those with Amazon and Microsoft, which have firm delivery timelines.

Financial Pressure and New Leadership

Intel’s situation remains urgent. The company posted a net loss of $18.8 billion in 2024 — its first annual loss since 1986 — as it battles to regain relevance in a market dominated by TSMC, Samsung, and other rivals.

Under Tan, Intel has:

- Overhauled its leadership team with new engineering hires.

- Started trimming layers of middle management.

- Begun rebuilding client relationships, a strength of Tan’s thanks to decades of experience in the semiconductor industry.

Shifting away from 18A for external sales would be one of Tan’s boldest moves yet, signaling a willingness to pivot from sunk investments in order to chase new opportunities.

Looking Ahead

Intel still plans to launch internal chips built on the 18A process — including the upcoming Panther Lake laptop processors, expected in late 2025. These chips are being positioned as the most advanced ever designed and manufactured in the U.S.

But for external customers, the spotlight is shifting. If 14A proves to be more competitive, Intel hopes to use it as the foundation of a reinvigorated foundry strategy capable of winning back lost ground in the global chip race.

Source:Reuters/other reliable sources.