“Liberation Day” turned out to be alarming. President Trump floored investors by announcing the largest tax hike on Americans since at least the 1940s.

April 2, which Trump called “Liberation Day,” was Trump’s deadline for unveiling a sweeping set of taxes on imports that almost nobody in the investing universe saw coming. For the first two months of his presidency, Trump had threatened tariffs, imposed some, delayed others, and generally left market watchers hoping his bark would be worse than his bite.

His bite turned out worse than his bark. The April 2 announcements included two sets of import tariffs. One is a new “universal” tax on imports from everywhere. The average tariff rate on imports at the start of the year was about 2.5%. So the 10% universal tariff on its own would raise the average tariff to 12.5%. That would be the highest since around 1940

TRUMP ANNOUNCES HIGHER RECIPROCAL TARIFF RATES FOR 185 COUNTRIES

Countries face duties of at least 10% in Trump’s new reciprocal tariff plan. Many will see a far higher rate.

| COUNTRY | WH EST. TARIFF RATE AGAINST U.S.* | U.S. RECIPROCAL TARIFF RATE |

|---|---|---|

| CHINA | 67% | 34% |

| EUROPEAN UNION | 39% | 20% |

| VIETNAM | 90% | 46% |

| TAIWAN | 64% | 32% |

| JAPAN | 46% | 24% |

| INDIA | 52% | 26% |

| SOUTH KOREA | 50% | 25% |

| THAILAND | 72% | 36% |

| SWITZERLAND | 61% | 31% |

| INDONESIA | 64% | 32% |

| MALAYSIA | 47% | 24% |

| CAMBODIA | 97% | 49% |

| UK | 10% | 10% |

| SOUTH AFRICA | 60% | 30% |

| BRAZIL | 10% | 10% |

| BANGLADESH | 74% | 37% |

| SINGAPORE | 10% | 10% |

| ISRAEL | 33% | 17% |

| PHILIPPINES | 34% | 17% |

| CHILE | 10% | 10% |

| AUSTRALIA | 10% | 10% |

| PAKISTAN | 58% | 29% |

| TURKEY | 10% | 10% |

| SRI LANKA | 88% | 44% |

| COLOMBIA | 10% | 10% |

| PERU | 10% | 10% |

| NICARAGUA | 36% | 18% |

| NORWAY | 30% | 15% |

| COSTA RICA | 17% | 10% |

| JORDAN | 40% | 20% |

| DOMINICAN REPUBLIC | 10% | 10% |

| UNITED ARAB EMIRATES | 10% | 10% |

| NEW ZEALAND | 20% | 10% |

| ARGENTINA | 10% | 10% |

| ECUADOR | 12% | 10% |

| GUATEMALA | 10% | 10% |

| HONDURAS | 10% | 10% |

| MADAGASCAR | 93% | 47% |

| MYANMAR | 88% | 44% |

| TUNISIA | 55% | 28% |

| KAZAKHSTAN | 54% | 27% |

| SERBIA | 74% | 37% |

| EGYPT | 10% | 10% |

| SAUDI ARABIA | 10% | 10% |

| EL SALVADOR | 10% | 10% |

| CÔTE D’ IVOIRE | 41% | 21% |

| LAOS | 95% | 48% |

| BOTSWANA | 74% | 37% |

| TRINIDAD AND TOBAGO | 12% | 10% |

| MOROCCO | 10% | 10% |

| PAPUA NEW GUINEA | 15% | 10% |

| MALAWI | 34% | 17% |

| LIBERIA | 10% | 10% |

| BRITISH VIRGIN ISLANDS | 10% | 10% |

| AFGHANISTAN | 49% | 10% |

| ZIMBABWE | 35% | 18% |

| BENIN | 10% | 10% |

| BARBADOS | 10% | 10% |

| MONACO | 10% | 10% |

| SYRIA | 81% | 41% |

| UZBEKISTAN | 10% | 10% |

| REPUBLIC OF THE CONGO | 10% | 10% |

| DJIBOUTI | 10% | 10% |

| FRENCH POLYNESIA | 10% | 10% |

| CAYMAN ISLANDS | 10% | 10% |

| KOSOVO | 10% | 10% |

| CURAÇAO | 10% | 10% |

| VANUATU | 44% | 22% |

| RWANDA | 10% | 10% |

| SIERRA LEONE | 10% | 10% |

| MONGOLIA | 10% | 10% |

| SAN MARINO | 10% | 10% |

| ANTIGUA AND BARBUDA | 10% | 10% |

| BERMUDA | 10% | 10% |

| ESWATINI (SWAZILAND) | 10% | 10% |

| MARSHALL ISLANDS | 10% |

Much beefier are “reciprocal” tariffs that are supposed to punish US trade partners that impose tougher barriers on imports from the United States than vice versa. To come up with those figures, Trump measured not just the taxes other nations impose on US imports but 14 categories of “nonmonetary” actions that Trump says keep American products out of foreign markets. That led to the eye-popping “reciprocal” taxes Trump now plans to impose on products from dozens of countries.

The current average tariff on imports from China, for instance, is about 3%. Trump wants to raise that to 34%. For Japanese imports, the tax will rise from 1.6% to 24%. For products from Europe, the tax will rise from the 2% range to 20%. The universal 10% tariff is scheduled to start on April 5, while the reciprocal tariffs are set to go into effect April 9. Unlike any change to income taxes or most other taxes, which require congressional legislation, Trump can impose tariffs on his own authority.

TRUMP ANNOUNCES HIGHER RECIPROCAL TARIFF RATES FOR ‘WORST OFFENDERS’

Countries face duties of at least 10% in Trump’s new reciprocal tariff plan. Many will see a far higher rate.

| COUNTRY | WH EST. TARIFF RATE AGAINST U.S.* | U.S. RECIPROCAL TARIFF RATE |

|---|---|---|

| CHINA | 67% | 34% |

| EUROPEAN UNION | 39% | 20% |

| VIETNAM | 90% | 46% |

| TAIWAN | 64% | 32% |

| JAPAN | 46% | 24% |

| INDIA | 52% | 26% |

| SOUTH KOREA | 50% | 25% |

| THAILAND | 72% | 36% |

| SWITZERLAND | 61% | 31% |

| INDONESIA | 64% | 32% |

| MALAYSIA | 47% | 24% |

| CAMBODIA | 97% | 49% |

| UK | 10% | 10% |

| SOUTH AFRICA | 60% | 30% |

| BRAZIL | 10% | 10% |

| BANGLADESH | 74% | 37% |

| SINGAPORE | 10% | 10% |

| ISRAEL | 33% | 17% |

| PHILIPPINES | 34% | 17% |

| CHILE | 10% | 10% |

| AUSTRALIA | 10% | 10% |

| PAKISTAN | 58% | 29% |

| TURKEY | 10% | 10% |

| SRI LANKA | 88% | 44% |

| COLOMBIA | 10% | 10% |

| PERU | 10% | 10% |

| NICARAGUA | 36% | 18% |

| NORWAY | 30% | 15% |

| COSTA RICA | 17% | 10% |

| JORDAN | 40% | 20% |

| DOMINICAN REPUBLIC | 10% | 10% |

| UNITED ARAB EMIRATES | 10% | 10% |

| NEW ZEALAND | 20% | 10% |

| ARGENTINA | 10% | 10% |

| ECUADOR | 12% | 10% |

| GUATEMALA | 10% | 10% |

| HONDURAS | 10% | 10% |

| MADAGASCAR | 93% | 47% |

| MYANMAR | 88% | 44% |

| TUNISIA | 55% | 28% |

| KAZAKHSTAN | 54% | 27% |

| SERBIA | 74% | 37% |

| EGYPT | 10% | 10% |

| SAUDI ARABIA | 10% | 10% |

| EL SALVADOR | 10% | 10% |

| CÔTE D’ IVOIRE | 41% | 21% |

| LAOS | 95% | 48% |

| BOTSWANA | 74% | 37% |

| TRINIDAD AND TOBAGO | 12% | 10% |

| MOROCCO | 10% | 10 |

Some of the Trump taxes are “stacked,” which means that multiple new tariffs might apply to some products. The matrix of overlapping new taxes compounds the confusion businesses already have to deal with as they try to understand what costs are likely to rise and by how much.

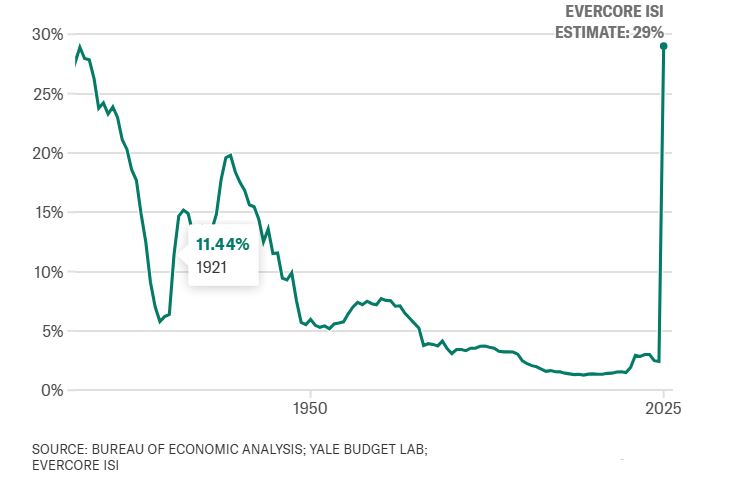

Americans bought about $3.3 trillion worth of imports in 2024. The tariff rate of about 2.5% yielded a tariff tax bill of about $83 billion. Investing firm Evercore estimates that all the new tariffs combined will push the tax rate on imports to about 29%.

If import purchases stayed the same, that would raise the tariff bill to about $960 billion, making it an $880 billion tax hike paid by American businesses and consumers.

“It’s the biggest tax hike on Americans since the 1940s,” trade expert Inu Manak of the Council on Foreign Relations told Yahoo Finance on April 2. “The only thing these tariffs are going to do is increase costs.”

U.S. TARIFFS TO BE HIGHEST IN OVER 100 YEARS UNDER TRUMP ‘LIBERATION DAY’ POLICY

Customs duty revenue as a percentage of goods imports

Economists are now busy trying to figure out whether the shock to corporate profits, stock values, and consumer wallets will be enough to cause a recession. Imports are only about one-tenth of total US GDP, which is nearly $30 trillion. So, as sweeping as the Trump tariffs are, they won’t affect everything in the US economy.