Beijing, July 15 — China’s economy showed modest resilience in the second quarter of 2025, growing slightly faster than expected despite mounting domestic and international challenges. However, soft consumer spending, falling prices, and escalating global trade tensions are prompting growing calls for fresh government stimulus.

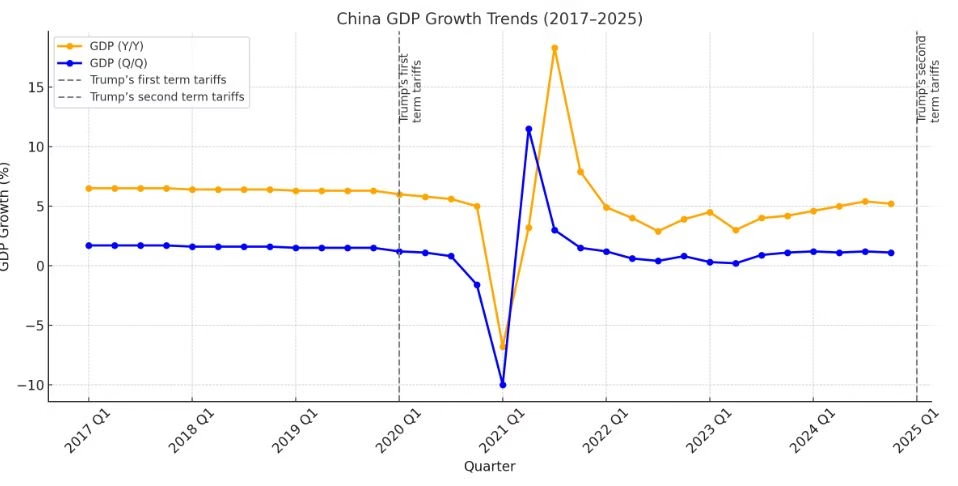

According to official data released Tuesday, China’s gross domestic product (GDP) expanded by 5.2% year-over-year from April to June. This marks a slowdown from the 5.4% growth seen in the first quarter but was slightly ahead of the 5.1% forecast by most analysts. On a quarterly basis, GDP rose 1.1%, beating expectations of 0.9% growth.

Economists noted that the economy benefited from front-loaded exports as Chinese manufacturers rushed shipments during a temporary trade truce with the United States. This helped offset some of the drag from persistently weak domestic demand and ongoing deflationary pressures.

“Stronger-than-expected growth in the first half gives policymakers more flexibility to tolerate a slowdown in the coming months,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management.

Still, concerns remain high about the outlook for the second half of the year, with analysts warning that the current momentum may not be sustainable. Export demand is expected to soften, property market woes persist, and consumer confidence remains low — all posing risks to China’s ambitious full-year growth target of around 5%.

Consumer Spending and Retail Weakness

June’s economic activity data revealed cracks in the recovery. While industrial output rose 6.8% year-on-year — the fastest pace since March — retail sales growth slowed sharply to 4.8%, down from 6.4% in May and the weakest reading since the early part of the year.

The impact is being felt directly by ordinary Chinese citizens. In Shenzhen, 30-year-old doctor Mallory Jiang said both she and her husband have faced pay cuts this year, forcing the couple to postpone major purchases.

“Our salaries have gone down, and we still don’t feel secure enough to buy an apartment,” Jiang shared. “We’ve started cooking at home, using public transport, and eating at the hospital cafeteria just to save money. Life still feels stressful.”

This cautious consumer behavior underscores deeper concerns about wages, job security, and the overall direction of the economy — concerns that stimulus alone may not fully address.

Policy Response and Market Expectations

Investors are watching closely for any new policy announcements from the upcoming Politburo meeting later this month. While authorities have already stepped up infrastructure investments, cut interest rates, and introduced subsidies, many analysts believe more aggressive measures may be needed if the slowdown continues.

Some economists suggest that China could ramp up deficit spending in the second half of the year to help offset weakening demand and counter the effects of trade tensions.

Markets responded with relative calm to the GDP data. The CSI 300 Index dipped slightly by 0.1%, while the Hang Seng Index in Hong Kong managed a 0.7% gain.

External Pressures and Property Market Slump

China’s export sector regained some strength in June as manufacturers rushed to meet deadlines before potential new U.S. tariffs take effect in August. However, this boost is expected to be short-lived as trade tensions resurface, especially with renewed pressure from the United States under President Donald Trump’s latest tariff proposals.

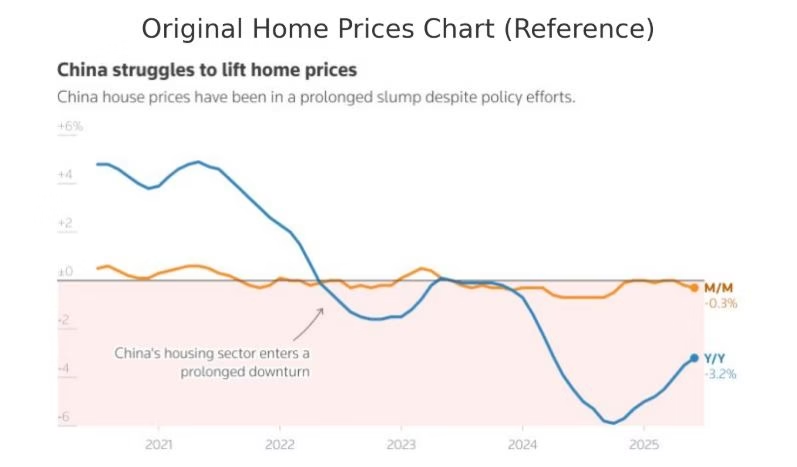

In addition, the ongoing slump in China’s massive property sector continues to weigh on overall growth. Real estate investment dropped sharply during the first half of the year, and new home prices in June recorded their steepest monthly decline in eight months.

In response, China’s leadership has vowed to accelerate urban village renovations and fast-track the rollout of a new property development model. These initiatives aim to revive confidence and stimulate activity in one of the economy’s most critical sectors.

Outlook for the Second Half

Looking ahead, many analysts are lowering their forecasts for the second half of the year. A recent poll projects GDP growth to ease to 4.5% in the third quarter and drop further to 4.0% in the fourth. For 2025 as a whole, growth is expected to average around 4.6%, falling short of Beijing’s 5% goal. By 2026, it may slow further to just 4.2%.

Although China has avoided a sharp downturn so far, the combination of slowing exports, domestic deflation, and cautious consumers suggests a challenging road ahead. Policymakers will need to strike a careful balance between stimulating growth and addressing long-term structural issues that continue to weigh on the world’s second-largest economy.

Reference : Reuters